Life insurance coverage plans have been haunting me lately, seriously. Like, here I am in my cramped apartment in suburban Chicago—it’s December 29, 2025, snow piling up outside my window, and I’m hunched over my kitchen table that’s doubling as a desk, surrounded by crumpled printouts from quotes I pulled last week. The radiator’s clanking like it’s judging me, and my coffee’s gone cold again because I keep getting lost in these numbers. I never thought I’d be the type to obsess over life insurance coverage plans, but after my buddy lost his dad unexpectedly last year, it hit me hard—I’m in my late 30s now, got a partner, a kid on the way, and yeah, I need to get this sorted before I chicken out.

Anyway, I dove deep into comparing the main life insurance coverage plans: term life, whole life, and universal life. And let me tell you, it was a rollercoaster. I started thinking term was obviously the winner because it’s cheap, but then I spiraled into “what if I live forever and waste all that money?” contradictions. Raw honesty? I almost bought a whole life policy on impulse from some slick agent who called me during dinner—felt like a total sucker move, hung up and regretted it for days. But after messing up a few online calculators (typed my age wrong twice, duh), here’s my flawed, human breakdown of these life insurance coverage plans.

Why I’m Even Thinking About Life Insurance Coverage Plans Right Now

Look, life’s messy. I’m freelancing from home, bills stacking up with holiday spending regrets, and the news is full of economic what-ifs. I want something that protects my family without bankrupting me now. According to Forbes Advisor, term life is way more affordable for most folks like me, but permanent options like whole or universal build cash value—which sounds fancy, but I screwed up early investments before, so I’m skeptical. NerdWallet says average term premiums are low in 2025, like under $50/month for decent coverage if you’re healthy. Me? I quit smoking last year—proud of that, but still waiting on bloodwork results, fingers crossed.

12+ Thousand Life Insurance Benefits Royalty-Free Images, Stock …

Stressed person at desk] A candid, slightly off-kilter shot of someone (basically me last week) buried in life insurance paperwork, forehead in hand, unusual angle from the side capturing the overwhelm and scattered notes, alt text: “Me stressing over life insurance coverage plans paperwork on my kitchen table.”

Breaking Down the Main Life Insurance Coverage Plans: Term Life

Term life insurance is like renting protection—straightforward, no frills. You pick a term (10-30 years usually), pay premiums, and if you kick the bucket during that time, your family gets the payout. Pros? Super cheap—I got quotes around $30/month for $500k coverage. Cons? It expires, and if you’re still kicking (hopefully), poof, nothing back. I almost went this route because it’s simple, but then panicked thinking about renewing at 60 with sky-high rates.

- Affordable premiums that stay level

- High coverage amounts easy to get

- Convertible to permanent sometimes

But yeah, no cash value—feels like throwing money away if you outlive it, which is the goal, right? Bankrate notes it’s best for temporary needs like mortgages or kids.

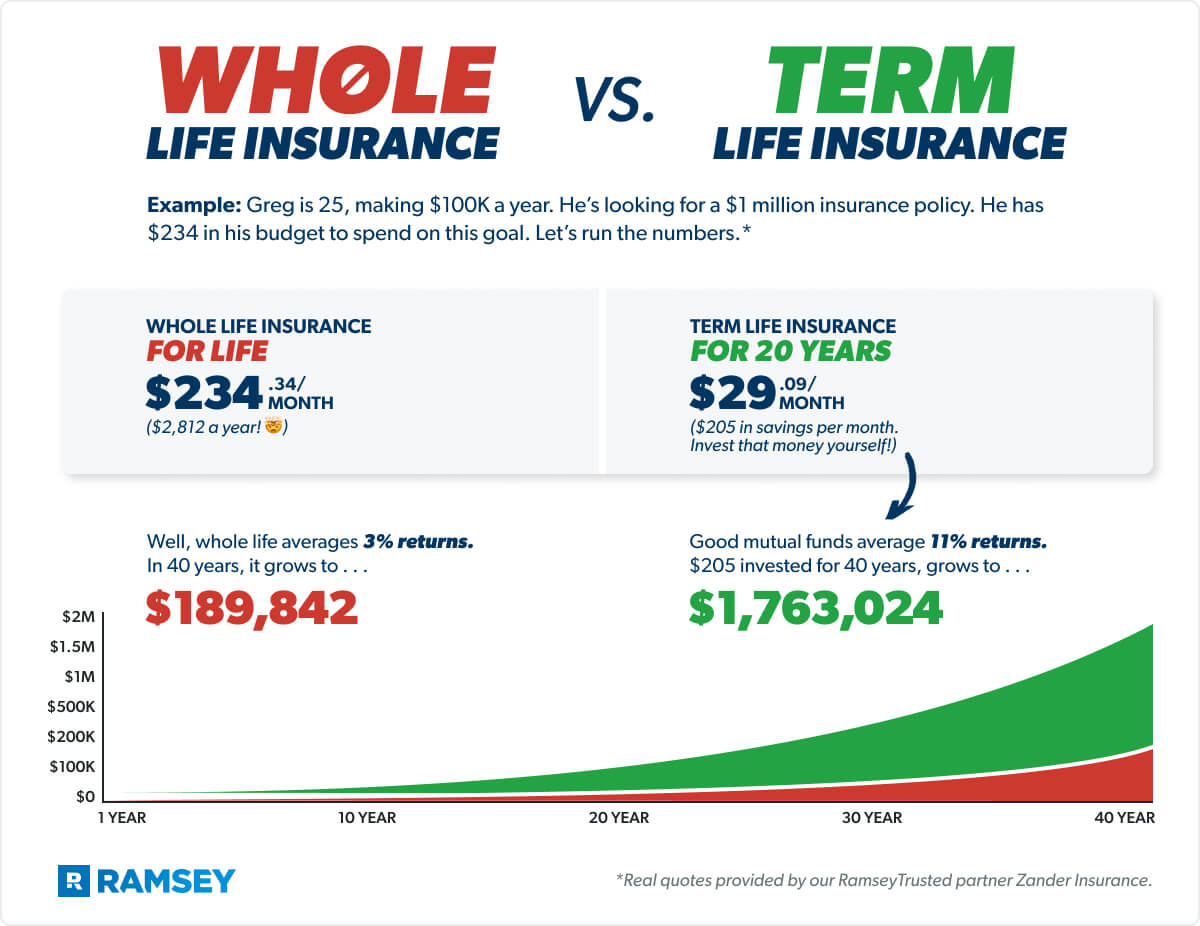

Term vs. Whole Life Insurance: What’s the Difference? – Ramsey

Comparison chart] My go-to infographic chart comparing life insurance coverage plans, from a personal bookmark perspective with my highlighter marks visible, alt text: “Handy chart I saved for life insurance coverage plans term vs permanent.”

My Take on Whole Life Insurance Coverage Plans

Whole life is permanent—covers you forever, premiums fixed, builds cash value like a forced savings account. I like the guarantees; no surprises. But holy crap, expensive—quotes were 10x term for me. Pros: Lifelong coverage, cash value grows tax-deferred, possible dividends. Cons: Locked in high payments, low returns compared to investing elsewhere. I flirted with it because an agent promised “wealth building,” but after crunching numbers, felt like overpaying for peace of mind I might not need. Guardian and MassMutual top lists for whole life in 2025.

One embarrassing story: I calculated wrong and thought I could borrow against cash value for a vacation—turns out early years, it’s mostly commissions. Lesson learned.

Universal Life Insurance Coverage Plans: The Flexible One?

Universal is permanent too, but adjustable—tweak premiums or death benefit as life changes. Cash value tied to interest rates, flexible but risky if markets tank. Pros: Adaptable, potential higher growth. Cons: Can lapse if underfunded, more complex monitoring. Indexed universal (IUL) links to stocks with floors—sounds cool, but caps limit upside. Investopedia warns of risks if rates drop.

I considered universal because my income fluctuates, but honestly, the admin scares me—I’d probably forget to adjust and let it lapse.

Health and life insurance concept, Family standing under insurance …

Family umbrella illustration] Illustrative family under a protective umbrella, quirky personal twist with everyday items like a kid’s toy nearby, alt text: “Dreaming of life insurance coverage plans as this safety net for my future family.”

So, Which Life Insurance Coverage Plan Is Best for You (or Me)?

It depends, duh—but for most average Americans like me, term life wins for pure protection, then invest the savings difference in a Roth or 401(k). That’s what Ramsey Solutions hammers home, and after my research, I’m leaning there. Whole or universal if you want legacy/estate stuff or maxed other savings. I messed up by waiting so long—don’t be me.

Talk to an independent agent, compare quotes on sites like Policygenius. Outbound links for credibility: Check Forbes’ 2025 best companies here, NerdWallet’s types guide, or Bankrate’s cheap options.

Wrapping this chat—I’m grabbing fresh coffee now, feeling less doomed. If you’re pondering life insurance coverage plans, start with term, get quotes today. Seriously, it’ll lift a weight. What’s your take? Hit me up in comments or whatever. Stay safe out there.