Anyway, fast forward to now, December 2025, sitting here in my apartment in California with rain pounding the window and my old Honda parked outside looking kinda beat up from all these potholes. Car insurance coverage plans feel more crucial than ever with rates skyrocketing—average full coverage is hovering around $2,300-$2,600 a year nationally, depending on who you ask. Mine jumped 15% this renewal, ugh. But I’ve dug deep into this mess, switched companies twice, and figured out what these plans actually include versus what the ads promise.

Why Car Insurance Coverage Plans Confuse the Hell Out of Everyone

Like, the jargon? Liability this, comprehensive that. I remember calling my agent last year, half-asleep with coffee in hand, asking “what does full coverage even mean?” He rattled off stuff, but it wasn’t until I read the fine print (after another near-miss on the freeway) that it clicked. Most of us just pick the cheapest quote and pray. Me? I went liability-only for years to save cash, thinking I was smart. Then a deer totaled my car in Oregon—yes, deer, random road trip gone wrong—and comprehensive would’ve saved my ass. Embarrassing story: I cried in the tow truck. Straight up.

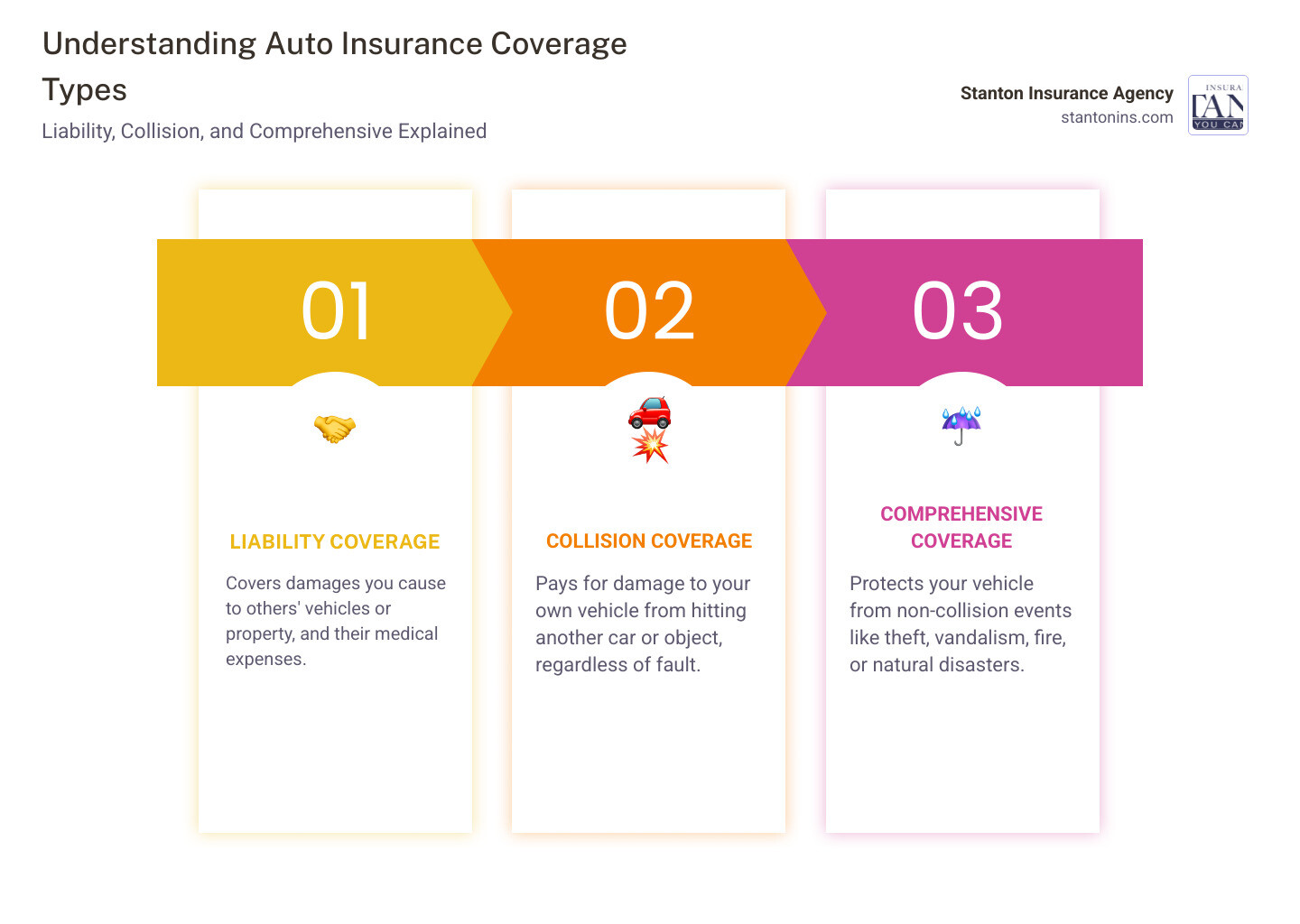

According to sources like NerdWallet and Bankrate, full coverage usually bundles liability with collision and comprehensive, but it’s not “everything” like some myths say.

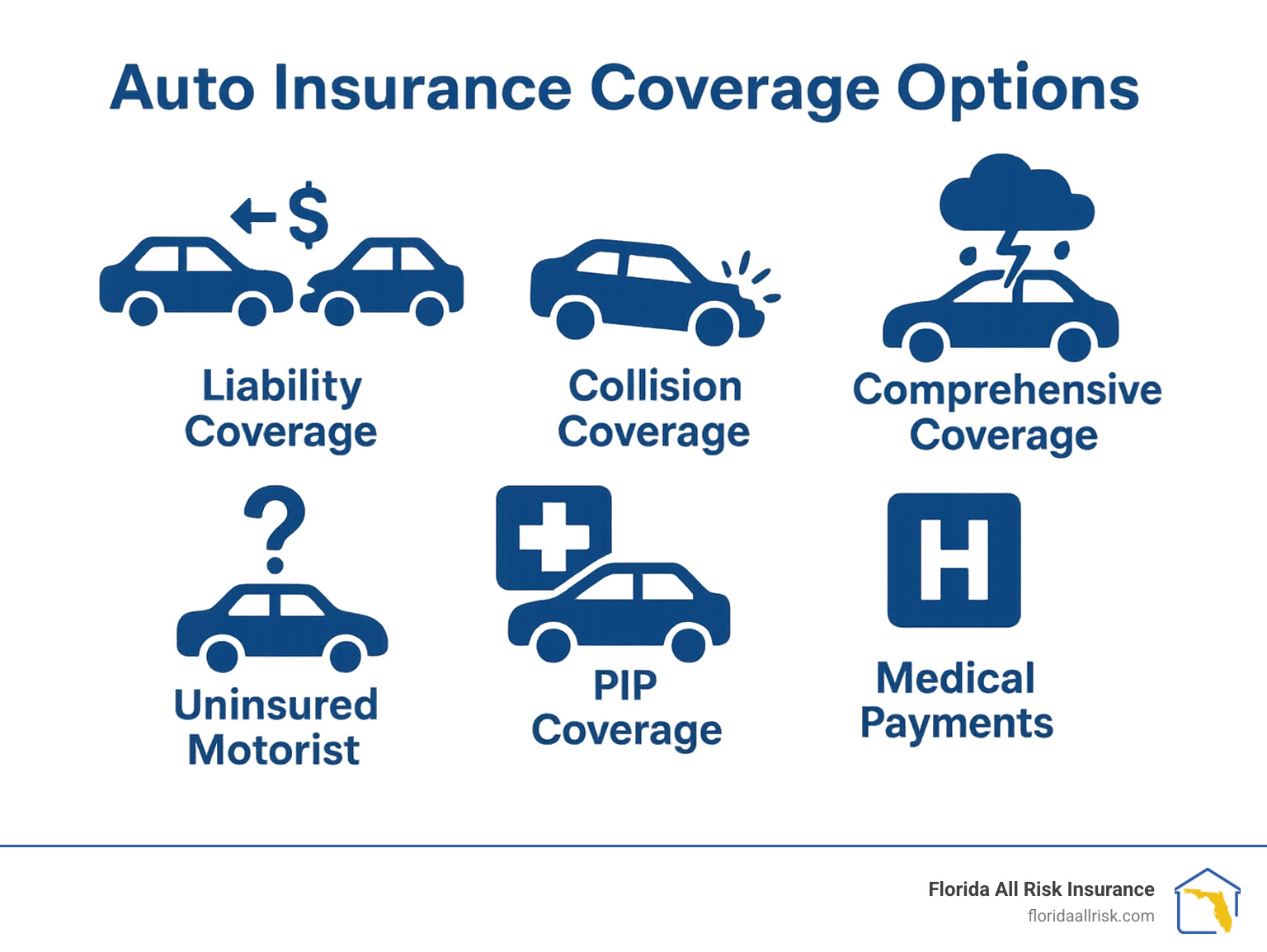

Here’s a quick visual I love for breaking down car insurance coverage plans.

Breaking Down the Main Car Insurance Coverage Plans I Actually Use

Okay, let’s get real about the core ones.

Liability Coverage in Car Insurance Coverage Plans (The Must-Have, But Not Enough)

This is the bare minimum in most states—covers damage you cause to others. Bodily injury and property damage. I had state min in Texas (30/60/25), and it wasn’t nearly enough when that fender bender turned into medical bills. Now I bump it to 100/300/100. Pro tip from my screw-ups: Go higher if you have assets. Sources like the Insurance Information Institute recommend it to avoid lawsuits eating your savings.

Collision and Comprehensive: The Real “Full Coverage” Heroes in Car Insurance Plans

Collision fixes your car if you hit something (or someone hits you and flees). Comprehensive? Theft, vandalism, weather, animals. That deer incident? Comprehensive. I added both now, even on my 2015 Honda, because repairs are insane—average claim over $5k these days. But deductibles matter; mine’s $500, ’cause $1k would kill me if I claim.

Kinda like this mess I dealt with last year.

Uninsured/Underinsured Motorist: Don’t Sleep on This in Your Coverage Plan

With so many drivers uninsured (like 1 in 8 nationally), this saved a friend of mine. Covers you if the other guy has no/no good insurance. I max it to match liability.

Other add-ons I dig: Rental reimbursement (super handy when my car was in shop for weeks), roadside assistance (I’ve used it twice for flat tires on road trips).

Common Myths About Car Insurance Coverage Plans That Bit Me

Red cars cost more? Total BS—I drive a red one now, rates same. Or that minimum is fine? Nah, myths like that left me broke. Full coverage means everything? Nope, no wear/tear or intentional stuff. Check III.org for more debunking.

How I Choose My Car Insurance Coverage Plans Now

Shop around—quotes vary wildly. I use sites like The Zebra or direct from top 2025 companies: Travelers (often cheapest per US News), GEICO, State Farm, Progressive. USAA if military. Check J.D. Power ratings for service. Bundle home/auto for discounts. Raise deductibles if you have emergency fund. Drive safe—my good record dropped rates 20%.

Average costs? Full around $2,300/year, but mine’s lower now in CA after switching.

Whew, that was a ramble. But honestly, car insurance coverage plans aren’t sexy, but getting them wrong sucks more than traffic. My advice? Get quotes from at least three places today—don’t wait for an oops moment like I did. Hit up NerdWallet or Bankrate for comparisons, talk to an agent, and build a plan that fits your chaotic life. You’ll thank yourself later. Drive safe out there!