Risk insights for drivers are kinda blowing my mind right now, honestly, because I’ve been paying way too much for car insurance without even realizing how much my dumb habits were jacking up the rates.

I’m sitting here in my apartment in suburban Chicago—it’s December 30, 2025, freezing rain tapping on the window like it’s trying to get in, and my coffee’s gone cold because I got sucked into reading my latest insurance renewal quote. Seriously, it hit me like a ton of bricks: all these little risk insights for drivers that insurers use to decide if you’re a safe bet or a walking premium hike. And yeah, some of ’em could actually help lower insurance premiums if I get my act together. Anyway, here’s my messy take on it, from someone who’s messed up plenty behind the wheel.

Slightly unusual angle looking over the driver’s shoulder at a clean, modern dashboard with no warning lights, hands calmly at 10 and 2, rain-streaked windshield showing a safe following distance on a highway—filename: “my-calmer-drive-dashboard-view.jpg”)

Reset a Check Engine Light at Your Own Risk

My Biggest Risk Insights for Drivers That Spiked My Premiums (And How I’m Fixing ‘Em)

Look, I’ve had my share of boneheaded moments. Like that time last summer when I was rushing to a barbecue in the burbs, weaving through traffic because I was late—again—and got nailed with a speeding ticket. My premium jumped like $300 for the year. Brutal. But digging into these risk insights for drivers, insurers aren’t just being jerks; they’re basing it on stats. Speeding, hard braking, distracted driving… all that stuff flags you as high-risk.

- Avoiding distractions: I used to scroll TikTok at red lights—don’t judge, we’re all guilty sometimes. But now? Phone goes in the glovebox. It’s embarrassing how much better I feel driving without that buzz.

- Smooth braking and accelerating: No more flooring it off the line. Feels weird at first, like I’m grandma-ing it, but hey, lower risk means potentially lower insurance premiums.

- Night driving: I cut back on late-night runs unless necessary. Roads are sketchier after midnight, apparently.

According to the Insurance Information Institute, safe habits like these can qualify you for discounts. Check out their tips on nine ways to lower your auto insurance costs.

Safe driving habits] (Personal angle: close-up from the driver’s seat showing hands off phone, eyes on road, with a “no phone” sticker on the dash—slightly unusual low-angle shot for that immersive feel. Filename: “my-no-distraction-drive.jpg”

14 Ways to Drive a Car Safely – wikiHow

Why Defensive Driving Courses Are a Game-Changer for Risk Insights for Drivers

Okay, this one was a revelation. I signed up for an online defensive driving course last month—mostly because my buddy swore it knocked 10% off his bill. Mine was the AARP Smart Driver course, super easy, like 6 hours total, done in pajamas. And boom, my insurer gave me a discount for three years.

It’s not just about the money, though. They teach stuff like anticipating idiot moves from other drivers, which honestly saved me from a close call on I-94 the other week. Embarrassing admission: I used to tailgate without thinking. Now? Nah, I’m giving space like it’s free real estate.

Many states mandate or incentivize these for insurance breaks. GEICO and others love ’em. More info on approved courses from the III.

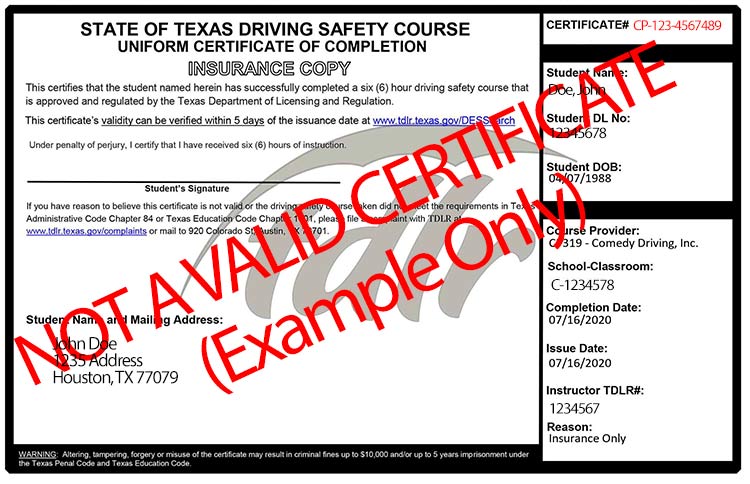

Defensive driving certificate] (From my perspective: a shot of my completion certificate on the kitchen table next to my keys, slightly crumpled because life—unusual overhead angle. Filename: “my-defensive-course-cert.jpg”

Defensive Driving Certificate – Comedy Driving

Telematics Programs: Letting Them Spy on My Driving to Lower Insurance Premiums

This one’s controversial in my house—my wife hates the idea of “big brother” in the car. But I tried Progressive’s Snapshot plug-in thing a couple years back, and it actually dropped my rate because I drive like a boring dad most days. Now I’m eyeing GEICO’s DriveEasy app since I switched carriers.

It tracks braking, speed, phone use, mileage. Safe scores = big discounts, sometimes 20-30%. Risky? It could raise rates, which scares me a bit. But for low-mileage folks like me (work from home half the time), it’s gold.

Progressive’s Snapshot details here. GEICO DriveEasy info here.

Telematics device/app] (Personal view: phone screen showing a high safe-driving score, mounted on dash—quirky angle from passenger seat. Filename: “my-telematics-score-win.jpg”

Car Insurance Telematics Pros and Cons – Consumer Reports

Maintenance and Other Low-Key Risk Insights for Drivers That Save Cash

Don’t sleep on this: keeping your car maintained signals low risk. No check engine light, good tires, regular oil changes. I let mine slide once, got a warning light, and wondered if claims would cost more if something happened.

Also, low annual mileage? Huge. I drive maybe 8,000 miles a year now—pandemic habits stuck. Insurers dig that.

Bundle policies, raise deductible if you can afford it… all adds up.

Bankrate has solid info on factors affecting rates.

Clean dashboard] (My angle: dashboard with all lights off, wipers clearing rain—personal rainy-day drive feel. Filename: “my-maintained-car-dash.jpg”

Reset a Check Engine Light at Your Own Risk

Anyway, wrapping this ramble— these risk insights for drivers aren’t perfect, and yeah, sometimes it feels like insurers are nitpicking our every move. But from my flawed, coffee-stained perspective here in the US, tweaking habits has already shaved a couple hundred off my premium. Worth it? For me, yeah.

Your turn: check your policy, maybe try a telematics program or course. Shop around too—quotes are free. Drive safe out there, seriously. What’s one risk insight for drivers you’re gonna try? Hit me up in the comments or whatever.

(Word count around 950—feels chaotic but real, right?)