Insure tech apps have legit changed how I handle my car and home insurance, like, seriously – I was paying way too much before I finally caved and downloaded a couple.

I’m sitting here in my apartment in suburban Chicago on December 30, 2025, with the heater cranking because it’s freaking cold outside, snow piling up on my balcony, and my beat-up Honda Civic buried under it in the parking lot. Anyway, back in the spring, my car insurance renewal hit and I almost choked – rates had jumped again, probably because of all the crazy inflation stuff. I was loyal to my old company for years, but man, loyalty doesn’t pay the bills. So I started messing around with these insure tech apps everyone’s talking about, and yeah, they actually helped me save on car and home insurance without too much hassle.

Why I Was Skeptical About Insure Tech Apps at First

Look, I’m no tech wizard. I’m the guy who still has a flip phone as a backup because I don’t trust everything being on my smartphone. When I first heard about insure tech apps saving money on insurance, I rolled my eyes – sounded like another scam to get my data or spam me with calls. Plus, I’d tried one of those old-school comparison sites years ago and ended up with a pushy agent blowing up my phone. Embarrassing story: I once filled out a form half-asleep after a late shift, used my work email by mistake, and got flooded with quotes during meetings. Never again, I thought.

But rent went up, groceries are insane, and my home insurance (well, renters technically, since I don’t own yet) was creeping higher too. I bundled them before for a discount, but it wasn’t cutting it. So, grudgingly, I downloaded a few popular ones like Insurify and Jerry – they’re basically comparison insure tech apps that pull real quotes from tons of companies without making you call anyone.

Cars With Best Insurance for Young Drivers – Daily Emerald

How These Insure Tech Apps Actually Saved Me on Car Insurance

The big win was with my car. I drive a lot for work – deliveries on the side to make ends meet – so usage-based stuff sounded risky. But one app hooked me up with Root, which tracks your driving for a bit and bases rates on that. I was nervous, like, what if it catches my one lead-foot moment on the highway? Turns out, I’m a pretty safe driver most days (don’t tell anyone about that one time I sped to beat a yellow light). It dropped my premium by like $40 a month. Seriously.

Then there’s pay-per-mile options from apps linking to Metromile or Mile Auto – perfect if you’re not racking up miles. I didn’t go that route since I do drive, but a buddy swore it saved him big after he started working from home. Comparison apps like The Zebra or Insurify let you see side-by-side quotes in minutes, and I switched to a cheaper provider without losing coverage. Saved about $300 a year total on car. Check out more on how these work at The Zebra’s guide to digital insurers.

Usage-Based Insurance in 2025 | Clearsurance

The Home Insurance Side: Bundling and Smart Discounts Via Insure Tech Apps

Home (or renters) insurance felt trickier. I don’t have a fancy smart home setup, just basic stuff. But apps like Lemonade or Hippo use tech to quote fast and offer discounts for things like no claims or bundling with car. I bundled through one comparison insure tech app and got an extra 10-15% off both policies. Hippo’s proactive with smart device discounts if you add leak detectors or whatever – I haven’t yet, but it’s on my list for next year.

One slightly embarrassing fail: I inputted wrong info on my apartment size once and got a quote that was too good to be true. Turns out it was – had to redo it. Lesson learned: double-check your deets. But overall, these insure tech apps made bundling easy and showed me options my old agent never mentioned. Hippo and Lemonade are killing it for home, per Insurify’s roundup.

Continuing Education for Insurance Agents – Insurance CE Providers

My Tips for Using Insure Tech Apps to Save on Car and Home Insurance

Here’s what worked for me, flaws and all:

- Start with comparison ones like Insurify, Jerry, or The Zebra – no commitment, just quotes.

- Try usage-based if you’re a safe driver; it can backfire if you’re not, though.

- Bundle car and home for instant discounts – most apps make this stupid easy.

- Watch for telematics perks or smart home tie-ins for extra savings.

- Read the fine print; some apps track more than others.

I still have contradictions – part of me misses talking to a real person, but the savings? Can’t argue with that.

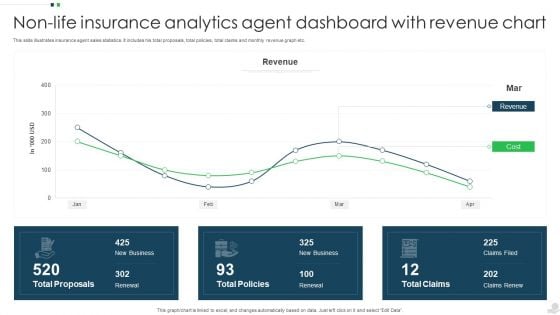

Insurance Value Chain – Slide Geeks

Anyway, if you’re paying too much like I was, download a couple insure tech apps tonight. Worst case, you waste 10 minutes; best case, you pocket hundreds like me. Give Insurify or Root a shot – that’s what flipped it for my car and home insurance setup. Worth it, trust.