Home insurance policy stuff has been kicking my butt lately, seriously. I’m sitting here in my cozy but kinda chaotic living room in suburban Ohio—it’s December 30, 2025, freezing rain tapping on the window, half-eaten takeout pizza on the coffee table because who has energy to cook right now—and I’m finally digging into my homeowners insurance renewal notice that just landed in my inbox. Premium up another 12%? Like, come on, man. I remember back in 2022 when I first bought this place, I just signed whatever the agent shoved at me without reading the fine print. Big mistake, huge. Felt like such an idiot later when I realized I was overpaying for crap I didn’t even need.

Anyway, these home insurance policy tips I’m about to spill? They’re straight from my own screw-ups and that glorious moment last year when I actually shopped around and saved over a grand. Not bragging, just saying—raw honesty here, I’m no expert, just a regular dude trying not to get fleeced.

Why My Home Insurance Policy Tips Actually Matter Right Now

Look, premiums are nuts these days—up like 30-40% in some spots since 2020 because of wildfires, hurricanes, inflation on building materials, all that jazz. I’m feeling it here in the Midwest too, even without the big catastrophes. My policy jumped because of “reinsurance costs” or whatever. But yeah, there are legit ways to fight back without leaving yourself exposed. According to the Insurance Information Institute, simple stuff like bundling or discounts can knock off hundreds. I learned the hard way.

(This is basically me last month, staring at bills with cold coffee going colder.)

Home Insurance Policy Tips #1: Shop Around Like Your Wallet Depends On It (Because It Does)

I didn’t compare quotes for years—lazy, right? Thought loyalty would pay off. Nope. Last spring I finally got quotes from three companies and switched. Saved $800 instantly. Bankrate says shopping is the top way to lower premiums in 2025. Don’t just renew blindly, y’all.

- Get at least three quotes online or through an agent.

- Check sites like Policygenius or directly with carriers.

- Do it annually, even if you’re happy.

Pro tip from my embarrassment: My old company had me on actual cash value instead of replacement cost. Switched and boom, better coverage for less.

Home Insurance Policy Tips for Bundling and Discounts—My Biggest Win

Bundling my home and auto? Game-changer. I was with separate companies forever because “that’s how it’s always been.” Dumb. Bundled this year and got 20% off both. Insurance.com says it’s one of the easiest saves, sometimes $400+ a year.

Other discounts I snagged:

- Security system (finally installed those cameras after a sketchy neighbor thing).

- Higher deductible (went from $500 to $2,000—scary but I have an emergency fund now).

- Non-smoker, good credit (worked on that score, paid off cards).

The III has a whole list of ways to save. Seriously, ask about everything—retiree, new roof, whatever applies.

How Much Does Security System Installation Cost in 2025? | Angi

(Me last weekend, finally putting up that camera. Felt like a dad win.)

Multi-Policy Discount – COUNTRY Financial

(Bundling visualized—wish it was this tidy in real life.)

Don’t Screw Up Your Home Insurance Policy Coverage—My Near-Miss Stories

Biggest regret? Underinsuring early on. Thought insuring to mortgage amount was enough. Wrong—land value doesn’t count, and rebuild costs skyrocketed. Now I make sure it’s full replacement cost.

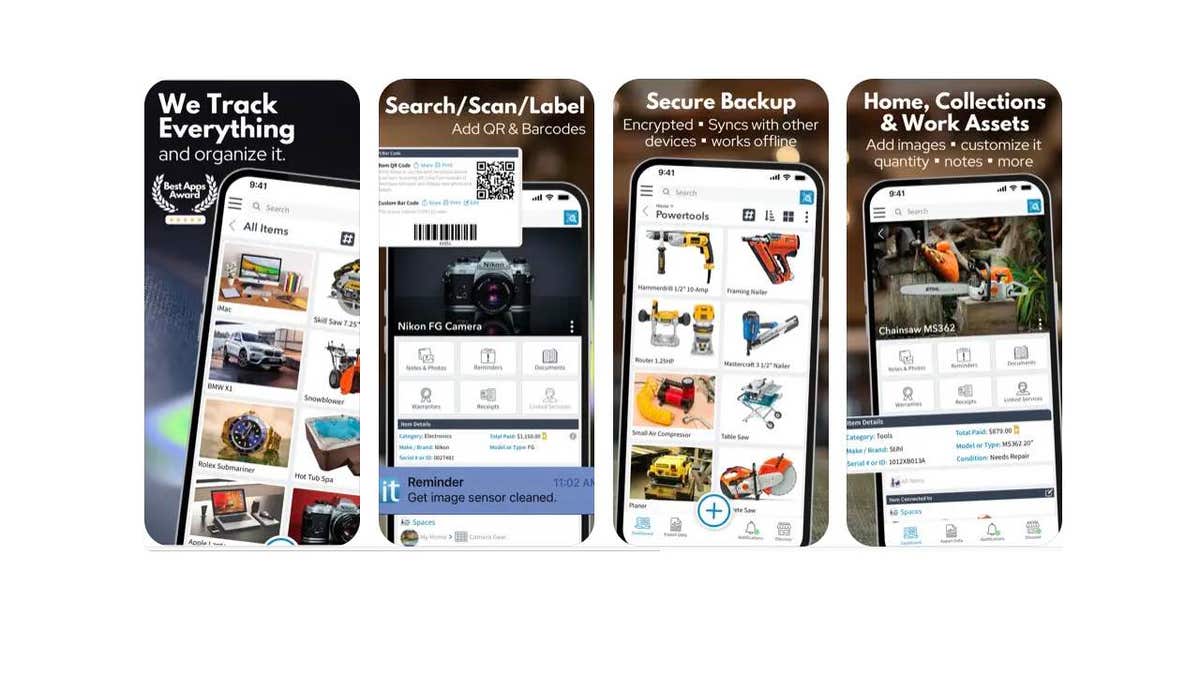

Also, do a home inventory. After a small basement flood (not covered, ugh), I realized I had no proof of half my stuff. Downloaded an app, photographed everything room by room. Tedious but peace of mind.

Best home inventory apps to protect your property in case of …

(Yeah, this app saved my sanity organizing valuables.)

And flood insurance? Separate thing. Learned that after chatting with neighbors post-storm. NAIC says don’t assume it’s included.

Wrapping This Home Insurance Policy Tips Ramble Up

Alright, I’m rambling now because that pizza smell is distracting me again. But seriously, these home insurance policy tips shaved thousands off over time for me—mostly by not being lazy anymore. Your situation might differ, rates vary by state, all that. But shop, bundle, discount-hunt, and review coverage yearly.

Go pull your policy right now, get some quotes, and thank me later (or don’t, I’m just venting my flawed journey here). What’s one tip you’re trying first? Hit me up in comments or whatever. Stay warm out there—2026 premiums incoming soon enough. Peace.