Health insurance plans totally dominate my brain right now, seriously, as I’m sitting here in my messy apartment in Chicago on this chilly December 29, 2025 morning, nursing a lukewarm coffee and staring at yet another Explanation of Benefits that makes zero sense.

Like, I thought I had this figured out last year, but nope—got hit with a surprise ER visit back in October because my kid thought skateboarding off the porch was a pro move. Ended up owing way more than I expected on my so-called “good” health coverage options. Anyway, I’m no expert, just a regular dude who’s messed up open enrollment twice now, paid dumb penalties, and finally learned some stuff the hard way. So here’s my unfiltered take on health insurance plans, contradictions and all, because this system is wild.

Why Health Insurance Plans Feel Like a Total Scam Sometimes (But Aren’t Always)

Look, I get it—I’ve ranted to my buddies over beers that health insurance plans are basically legalized gambling. You pay premiums every month hoping you never need it, then when you do, bam, deductible hits you like a truck. My family plan through work? Costs us almost $27,000 a year total now in 2025, per what I’ve read on sites like KFF.org. Workers like me chip in thousands outta pocket. But then I remember that one time without insurance in my 20s when a stupid appendix burst and I was drowning in debt… yeah, having health insurance plans saved me from worse later. It’s flawed as hell, but necessary. Contradictory? Totally me.

(Yeah, that’s pretty much me last week, digging through paperwork with my laptop open to Healthcare.gov, head in hands.)

The Main Types of Health Insurance Plans: My Breakdown After Too Many Late Nights Researching

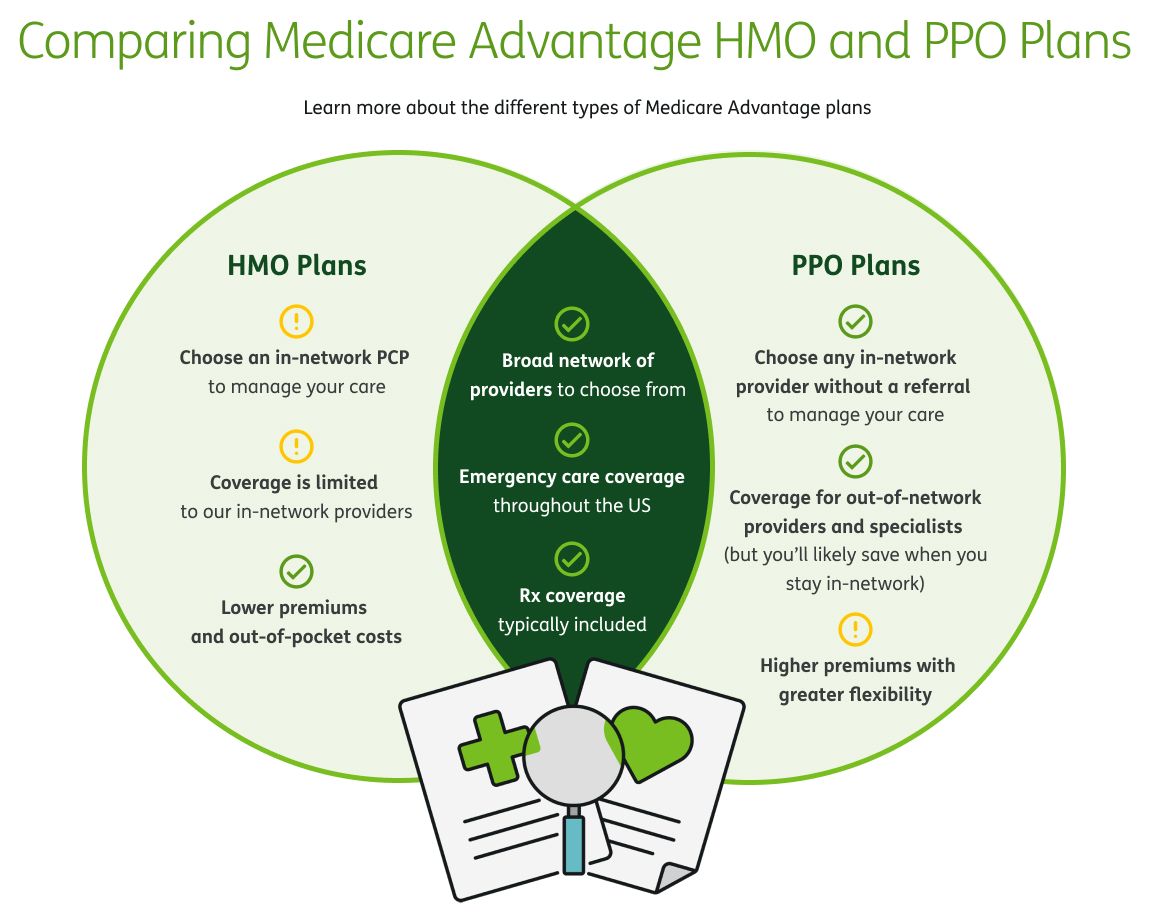

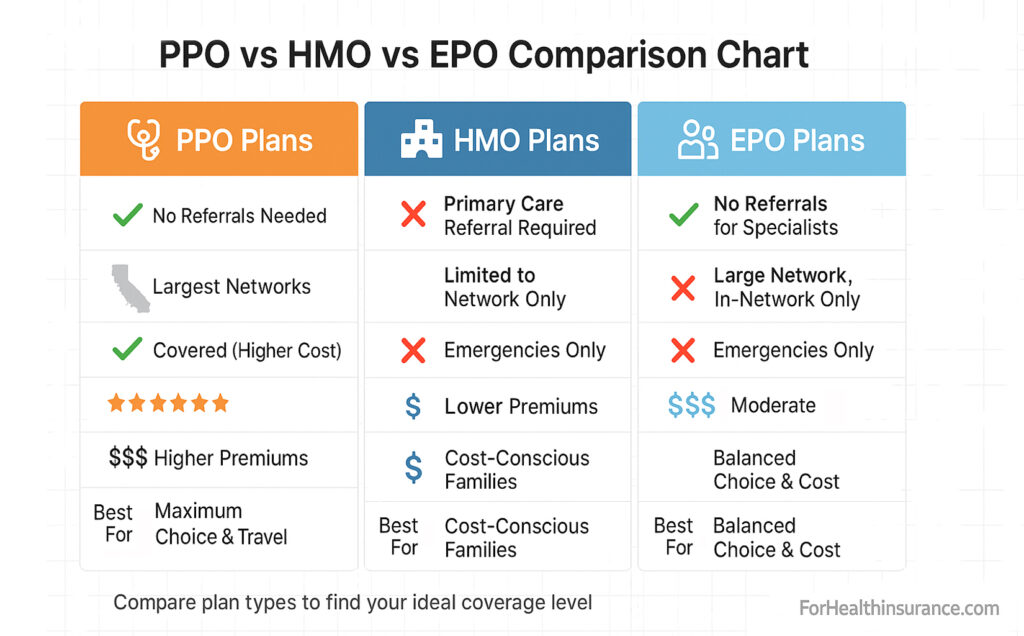

There are a bunch of health coverage options out there, but most boil down to these. I switched from an HMO to a PPO last year and regretted it premium-wise, but loved the flexibility.

- HMO (Health Maintenance Organization): Cheaper premiums usually, but you gotta stick to their network and get referrals for specialists. I had one—it was fine until I needed a dermatologist outta network. Denied. Frustrating.

- PPO (Preferred Provider Organization): More expensive, but freedom to see anyone. No referrals needed. This is what I have now—worth it for my wife’s specialists, but ouch on costs.

- EPO (Exclusive Provider Organization): Like HMO but no referrals, still stuck in network.

- POS (Point of Service): Hybrid—referrals needed for out-of-network.

Then there’s the metal tiers on marketplace health insurance plans: Bronze (cheap premium, high deductible), Silver (middle, often best subsidies), Gold, Platinum (low out-of-pocket but sky-high premiums).

(This chart saved me hours—simple HMO vs PPO comparison. Wish I’d seen it sooner.)

Check out the official rundown on plan types at HealthCare.gov.

Health Insurance Plans Costs in 2025: The Numbers That Make Me Cry

Real talk: Average employer family premium hit $26,993 this year. Singles around $9,325. On the marketplace? Unsubsidized averages around $7,000-$8,000 annually, but subsidies can slash that if your income qualifies. My big mistake? Not checking subsidies when I was between jobs—paid full freight like an idiot.

Deductibles? Often $1,900+ for individuals. Out-of-pocket max caps it, thank god.

Navigating Open Enrollment for Health Insurance Plans: Don’t Sleep on This Like I Did

Right now, as of December 29, 2025, we’re smack in open enrollment for 2026 coverage—runs November 1, 2025 to January 15, 2026 in most states. Miss it (like I did once), and you’re stuck unless life event qualifies you for special enrollment.

Pro tip from my screw-up: Shop early on HealthCare.gov or your state marketplace. Compare actual costs after subsidies.

Lots of Health Insurance Help in Covid Relief Law — But Do Your …

(That’s the site I stare at way too much—Healthcare.gov marketplace screenshot vibes.)

Key Terms in Health Insurance Plans That Tripped Me Up

- Premium: Monthly bill, pay or no claims.

- Deductible: What you pay before insurance kicks in.

- Coinsurance: Your percentage after deductible.

- Out-of-pocket maximum: Caps your yearly spending.

- Copay: Flat fee for visits.

Full glossary here if you wanna dive deeper: HealthCare.gov Glossary.

Wrapping This Chat on Health Insurance Plans: My Final Messy Thoughts

Health insurance plans are confusing, expensive, and imperfect, but ignoring them is worse—trust me, I’ve got the scars. I’ve learned to compare every year, use subsidies if eligible, and pick based on my actual doctor needs, not just lowest premium.

Anyway, if you’re reading this, go check your options now before January 15 hits. Head to HealthCare.gov, plug in your info, see real numbers. You might save big or avoid my mistakes. Hit me up in comments if you got questions—I’m no pro, but I’ve lived it. Stay covered, friends.